Raising a seed round 101The whys, whats, and hows of seed funding, with advice from the founders of Notion, Linear, Figma, Ramp, Instacart, 37signals, and more👋 Hey, I’m Lenny, and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career. For more: Best of Lenny’s Newsletter | Hire your next product leader | Podcast | Lennybot | Swag

Fundraising is arguably the most heartbreaking, confusing, and high-stakes part of a founder’s job. You have to learn how to do it from scratch, stay positive in spite of incessant rejection, and if you don’t get it right, your company dies. Then you have to do it over and over and over again. Don’t get it right once? That’s right, your company dies. Considering how essential getting this right is for most founders, it surprised me that I’d never come across a great, in-depth, practical how-to guide on raising a seed round—especially one written by people who’ve been through it hundreds of times. So I pulled in two of my favorite co-investors to write one: Terrence Rohan and Jack Altman. Terrence and Jack have been involved with over 1,000 seed rounds, and are my go-to people whenever I need fundraising advice. Below, you’ll learn:

To make this guide even more practical, they’ve integrated anecdotes and advice from the founders of some of today’s most iconic companies. If you’re planning to raise a seed round, this guide is for you. Terrence is a seed investor building a new type of angel fund, Otherwise. Previously he managed the seed practice at Index Ventures. He has supported companies like Figma, Notion, Vanta, Hugging Face, and Robinhood from their earliest stages. You can find him on X, LinkedIn and trohan.com. Jack is the founder of Alt Capital, a brand-new early-stage venture that raised its first $150 million fund in February. Before starting Alt, he was the founder and CEO of Lattice, where he currently serves as chairman. For more from Jack, follow him on X. We’ve watched this process play out from both the VC and founder sides. Collectively, we’ve seen over 1,000 seed fundraises—including tactics that work and tactics that are harmful. Although each situation is different, and there’s no one simple answer to these questions, our goal with this post is to help deepen founders’ understanding of the nuances of raising a seed round and help you take the right steps for your company. We reached out to some of our favorite founders to ask them for candid advice to supplement our own experience on both sides of early-stage pitches. Thank you to Christina Cacioppo (Vanta), Dylan Field (Figma), Eric Glyman (Ramp), Ivan Zhao (Notion), Jason Fried (37signals/Basecamp), Josh Miller (The Browser Company), Karri Saarinen (Linear), Mathilde Collin (Front), Max Mullen (Instacart), Tomer London (Gusto), Qasar Younis (Applied Intuition), Siqi Chen (Runway), and Zach Perret (Plaid), who collectively have raised nearly $9 billion in venture capital. You’ll see insights from all of them incorporated throughout this guide. Should my company raise venture capital at all?Vanta founder Christina Cacioppo looks at it this way: “If you think you can build a business that makes hundreds of millions of dollars a year, you don’t mind ceding some decision-making to someone who doesn’t work at your company day-to-day, and you want to grow an organization faster than it would naturally grow,” then taking some venture might be the right decision for you. Seed capital has historically been the first formal round of venture capital (i.e. why it’s called a “seed” round). Smaller rounds are sometimes branded “pre-seed” or “angel” rounds, and larger ones are sometimes called “mango seed”—but all these fall under the umbrella of a seed round. A seed round typically entails raising $1 million to $4 million from a variety of investors and most likely doesn’t involve the creation of an outside board (we’ll break this down in more detail later). You should pursue raising a seed round if you have conviction on the following points:

If you answered no to any of these questions, seed capital might not be right for you, and that is OK. There are advantages to not raising (e.g. less dilution, more control, and fewer voices in the room). If you can manage it, there can also be benefits to delaying your seed fundraise. Jason Fried of 37signals advises, “Raising money too early teaches you how to spend rather than earn. When flush with cash, you’re encouraged to spend and raise more, practicing skills that won’t sustain your business long-term. Building a self-sustaining business requires practicing making money—a skill that, like playing an instrument, takes considerable time to master. The sooner you start practicing, the better. And there’s no better practice than having to make more than you spend right from the start, especially when it’s yours that you’re spending.” It’s worth noting that just because you raise a seed round doesn’t mean you need to raise tons more venture capital. VCs can commonly “over-prescribe” venture capital, both in terms of frequency and amount (if you are a hammer, everything is a nail). Just because you took a little doesn’t mean you’re obligated to take a lot. Related, it’s helpful to remember that focusing on the business and not on venture capital might be one of the strongest approaches to both. Ivan Zhao at Notion puts it this way: “You can decide your energy allocation between selling/socializing vs. building. At least for Notion, I believe if you built something great, the network will come and the investors will say yes. So we spent most of ours on the latter, as opposed to the tactics for the former.” What do I need to prove to investors before I raise?Every round of venture capital requires you to build a case to investors. For them to want to invest, they need to believe you are positioned to build an important and enduring business. Unfortunately, there isn’t consensus in the market for what that proof looks like or how far along you need to be in order to raise, and each investor has a different approach to picking their investments. Some founders raise a seed with a built product and paying customers; others simply have a deck and an idea. Generally speaking, before you raise, you should have taken the following steps:

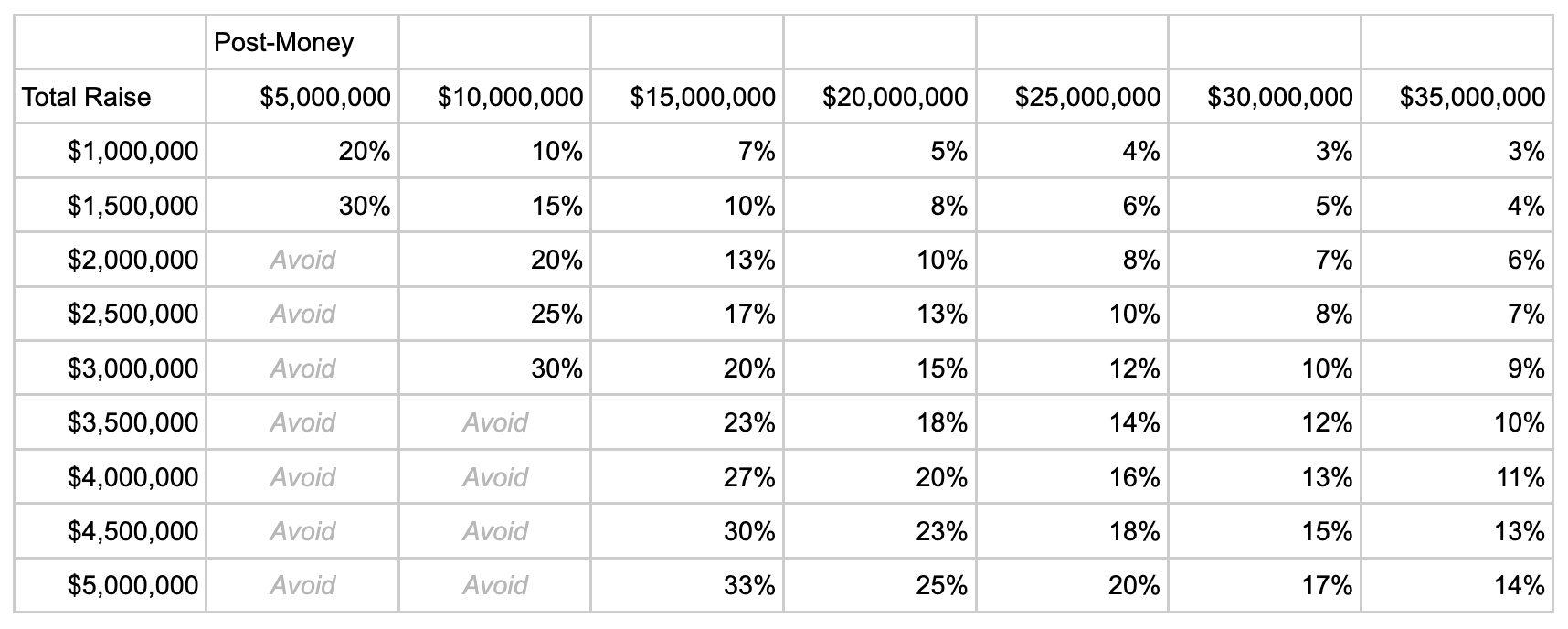

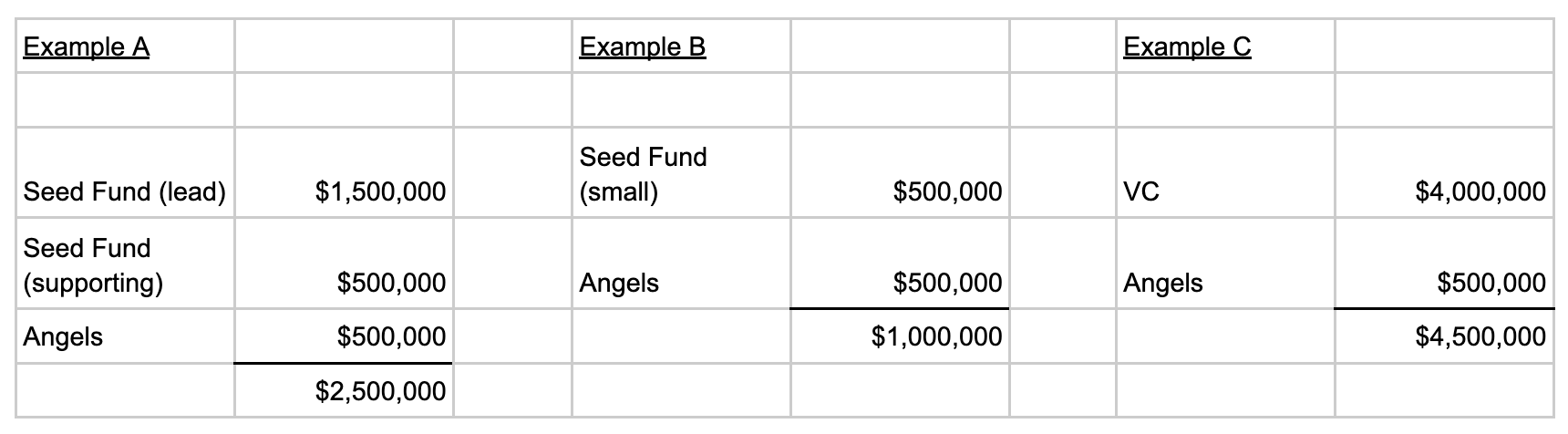

Importantly, your own conviction across all three of these points might be the single most predictive variable in raising capital. If you truly believe in the opportunity, you will likely be able to convince someone to give you money. How much should I raise?A simple formula is to aim for a 24- to 36-month runway, building in a 25% buffer. Why 24 to 36 months? Generally, this is the right amount of time because it tends to be about how long it takes to hit product-market fit (and ideally become default alive) and/or raise a series A. As one data point, Carta has the median time from seed to Series A as 23 months. You also probably want a 25% buffer because unexpected things always happen. Here’s a simple spreadsheet illustrating how to model this out. Most seed rounds now are around $2M to $4M. Some companies require much less or much more to get going, so think carefully and use your judgment. As of today, a typical post-money valuation will be around $20M (in the San Francisco Bay Area). It is typical to sell around 15% equity in a seed round. If you want to raise $2M to 3M, it’s also better to say you are raising $2M than to say you are raising $3M. It’s always better to be oversubscribed than fail to reach your target. Here is a table outlining common dilution scenarios from a seed round. It’s worth remembering that when you take the venture path, outcomes tend to be sufficiently binary so that if you are the founder of a successful startup, you will end up with life-changing money regardless of the dilution you took. Taking on too little funding can limit your company’s performance, but taking on too much can have its own downsides. Too much capital, especially too early, can reduce urgency and innovation, and contribute to unnecessarily high headcount and burn. There are exceptions to every rule, but generally, if you raised 2 to 3x or more than a typical seed round for your category, you probably raised too much. According to Linear founder Karri Saarinen, “With each round, you want to think simultaneously that it is the last round you’ll ever raise—ideally you get to profitability and don’t need to raise— and that you’re raising enough to hit the milestones that you need to get to the next valuation range.” Creating a product customers love and pay for and keeping profitability as a plan B is more likely to maximize your company’s odds of survival as well as the odds of your raising your next round. “First and foremost, build a great business,” says Plaid founder Zach Perret. “Fundraising is easy if you identify a great market and find a unique customer insight, so do that first.” What should I know about seed round sizes and compositions?AngelList and Carta have good third-party data on the latest round sizes and valuations. Most rounds are put together with at least one big check (seed fund or multi-stage firm) and any number of angels and smaller funds. The big check is typically referred to as the “lead investor,” and the smaller checks traditionally provide an entry point for strategic investors who bring signal value (e.g. Elad Gil) or specific skills to the table (e.g. growth, distribution, hiring). There is no universal “right” way to put together a seed round. You can do it with a single seed fund, a constellation of angels, with a multi-stage VC, and everything in between. Below are some examples: Rising above the numbers, Dylan Field of Figma advises, “Treat this as the start of a very long-term relationship, not a one-off transaction or optimization puzzle. Find people you love spending time with and want to learn from over time.” Seed-stage venture capital comes primarily from three different types of investors: angels, seed funds, and multi-stage firms.

To find investors, we believe the most comprehensive third-party resource is Crunchbase. We recommend one of two approaches:

As a sweet bonus, Crunchbase gave us an exclusive discount for readers of Lenny’s Newsletter: Get 20% off your first year of Crunchbase Pro with code LENNY20. How do I maximize the odds of raising a great seed round?To maximize the odds of a successful raise, you need to choreograph your approach to maximize the number of potential options. Raising a seed round comes down to activating emotional triggers in prospective investors, including the fear of missing an incredible opportunity. The most surefire to get a yes from many investors is to get a yes from other investors. In short, you have to create FOMO among investors. Here’s how to do that: 1. Plan your raiseYou probably double the odds of success if you spend some time planning your raise. Carve out a two- to three-week window on your calendar to run your fundraise and speak to investors. Ideally, you want to speak to as many investors as possible in the shortest period of time. This compression of time creates the conditions for desire and scarcity, which can help prompt an investor to a yes. Here is a link to a sample timeline you can use to plan your raise. Related, there is a common question about whether to build relationships with investors when you are not raising. Relationship building with investors “off-cycle” is fine, but don’t let relationship building turn into a situation where the investors gain control of your fundraise. The main principle around planning is that you drive and architect the process. As such, if investors are talking about a pre-emptive term sheet, be thankful and gracious, but then confidently tell them when you are going to be raising—and say that is the time when you are accepting term sheets (notice the power flip). This will not “turn them off.” In fact, it will likely have the opposite effect. The reason you want to slot even “pre-emptive” offers into a larger process is to weigh all potential options and potentially have more leverage on terms. 2. Do your research on investorsAssemble your target list and research each investor before your pitch window. Have they invested in similar companies? (Check Crunchbase and their LinkedIn.) What’s their check size and investment philosophy, and do they lead? (Check their fund and personal website.) What do other founders think of them? (Ask for references from other founders.) Here is a spreadsheet to help organize your outreach. But all seed investors are looking for large return multiples on any investment—typically over 100x—and evaluate based on the caliber of the team, the size of the market, and the strength of the early product. 3. Prepare (well-crafted) materialsA minimal deck and/or memo with a simple budget is all that you’ll need at this stage. You need to show there’s a real problem to solve, in a big enough market, and that you’re the one to solve it. That’s it. However, the quality of this content matters a lot. The better crafted the materials, the more persuasive they will be, and the more likely they will result in capital. You should have all your materials polished and ready to go before your pitch window, and you should be ready to tailor your pitch to each prospective investor. Sequoia has a great template for a deck, as does YC. And Rippling wrote the gold standard for a memo. (But craft doesn’t have to mean visual finesse. It’s more important for the deck to be substantive than beautiful. Airbnb’s seed deck is a good example.) Remember to strive for honesty, not just optimism. Tomer at Gusto says, “Show your honest assessment of your scorecard,” while Dylan of Figma advises, “Be honest about what you know and don’t know.” 4. Get powerful, warm introsWho introduces you to prospective investors matters a lot more than you might think. Take the time to consider your most powerful connection to each investor before you ask for introductions. High-influence intros for prospective investors include:

Naturally, the stronger the relationship, the more powerful the intro will be. There are also low-influence intros, such as investors who are not investing in your company (politely decline these, as they are a negative signal), and lawyers or other service providers (these are typically harmless but usually not very helpful). Here’s how Siqi Chen from Runway puts it: “The most important thing is to make sure your warm intro is from someone genuinely excited about you. When an investor knows someone they respect is putting their social capital on the line, you get to break through the noise.” If you can’t find a warm intro, craft a good cold email. These don’t convert as well, but there is almost zero downside to sending one. 5. Practice and prep your pitchYour presence in a meeting matters even more than your materials. Showing up as the best version of your authentic, relaxed, and confident self is key. And that’s not something you can wing. Here’s what to do and know before you start speaking to investors:

6. Start small to build social proofYou don’t need a lead investor to start taking on capital in a seed round. In fact, it is often better to open a SAFE (simple agreement for future equity) at reasonable valuation and start collecting the checks of smaller angels while you are having conversations with larger funds. Not only will you be taking on capital, but you’ll build social proof for the larger investors. 7. Follow up sparingly with investors, and never chase or “back-channel” them without strengthInterested investors will typically drive the process (more on this below). If you do have to follow up over email, do it sparingly, and don’t chase investors in a needy way. In such follow-ups, always pepper in some positive development, whether in revenue, a new hire or feature release, or additional angels closed (see above). Related, having an angel or existing investor check in, chase, or pressure lead checks often backfires. Savvy VCs and lead investors will take this pressure as a sign of weakness. If there is any sort of “back channel” that works, it’s having angel or existing investors saying they “vouched” for the lead check, as a type of reference. With this, you flip the power dynamic. 8. For bigger checks, never reveal who else you are talking toMystery is always more seductive than the truth. Never reveal the actual names of who gave you a term sheet. Just accurately describe them in the abstract (and never lie). 9. You don’t have a term sheet until you have an actual term sheetVerbal commits are not term sheets. In seed, a term sheet is commonly a SAFE with a post-money cap. You don’t actually have a commitment from an investor until you have a term sheet or a SAFE. This carries through to every round you raise. 10. Your round is not closed until it’s closedWhile less common at seed, rounds are actually not closed until the funds wire. Set reasonable but quick dates for closes (wires). Keep everyone moving toward those dates. This carries through to every round you raise. How do I talk terms in a seed raise?The only terms that really matter at seed are the post-money valuation and whether there is a board. Post-money valuation is the value of the startup, including the capital raised. Third-party sources like AngelList or Carta, fellow founders, and advisors can help you triangulate a good range for your valuation. When negotiating the post-money, it’s helpful to remember that investors are primarily solving for ownership (i.e. free percentage of the company they’ll own), which is slightly different than price. Most seed rounds are done on SAFEs, which have the benefit of speed because you don’t need to negotiate terms other than the valuation, and there are typically no lawyers involved. A minority of seed rounds are “priced,” meaning investors buy preferred shares immediately. Priced rounds take a little longer to close and cost more, but they make the cap table and dilution more clear for founders because there’s no contingency on the next round of financing. Creating a board with an outside investor is less common at seed. It is usually preferable to avoid giving up a board director seat at seed unless someone truly remarkable wants to join your board. Instead, offer a board observer seat when an investor asks for a director seat. Directors have voting power; observers do not. A note about dilutionTo be sure, you don’t want to put yourself in a position where the cap table inhibits your ability to run the company. However, the most important thing is that you get the capital and partners you need to get the company to its next milestones. “My top advice to founders is to try to optimize their rounds to get the most helpful investors involved early, and to worry less about optimizing the price and other terms of the round,” says Instacart founder Max Mullen. You can only raise a lot of money and take little dilution if you are in an unusual position of strength (i.e. multiple term sheets), which is rare. As a rule of thumb in the early stage, it’s ideal if you can get through your series A with less than 40% dilution from investors. You’ll also incur a typical 10% to 15% of additional dilution from your ESOP (employee stock ownership plan), bringing total dilution to 50% to 55%. Less dilution is obviously better, but the higher-order bit is that you get the capital you need from the partners you want. You can see more about the range of founder equity ownership at IPO here. How do I know if a fundraise is going well?...Subscribe to Lenny's Newsletter to unlock the rest.Become a paying subscriber of Lenny's Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Search thousands of free JavaScript snippets that you can quickly copy and paste into your web pages. Get free JavaScript tutorials, references, code, menus, calendars, popup windows, games, and much more.

Raising a seed round 101

Subscribe to:

Post Comments (Atom)

Top 3 UX Design Articles of 2024 to Remember

Based on most subscriptions ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

code.gs // 1. Enter sheet name where data is to be written below var SHEET_NAME = "Sheet1" ; // 2. Run > setup // // 3....

No comments:

Post a Comment